Introduction

For many of you entering your first job as a Foundation Doctor, receiving your first paycheck can be an exciting experience. However, it's easy to overlook key details in the excitement. Let's break down a few key points to make more sense of it.

When do I get paid?

The timing of your paycheck can vary between different trusts for standard employment. Typically, you can expect it at the end of the month. Some trusts pay on the last working day, while others have a fixed date, such as the 25th of each month. In the case of locum (bank) work, payments may be issued weekly or fortnightly. Payroll information can be delivered through an e-payslip or a physical letter.

What will my salary be?

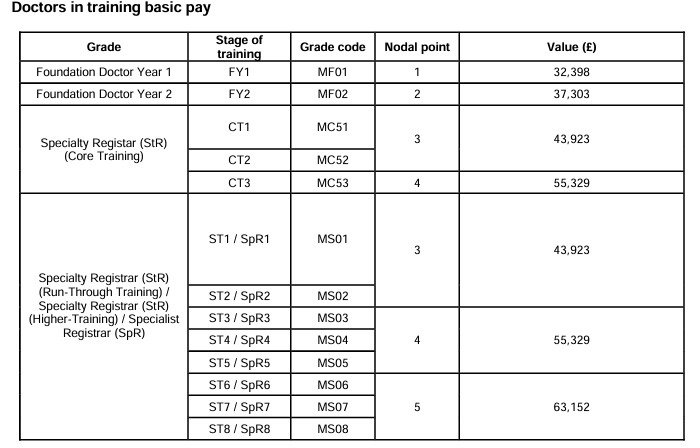

The variation in pay depends on several factors. To arrive at the monthly take-home pay, we must consider how pay varies based on the job. All Foundation Doctors receive a 'base rate.' Additional hours beyond the standard 40 hours, night shifts, and weekend cover contribute to the overall pay. This is often presented to you as a set annual salary. Take a look at the BMA Pay Scales below to get an idea of how pay scales with experience.

Understanding the Paycheck

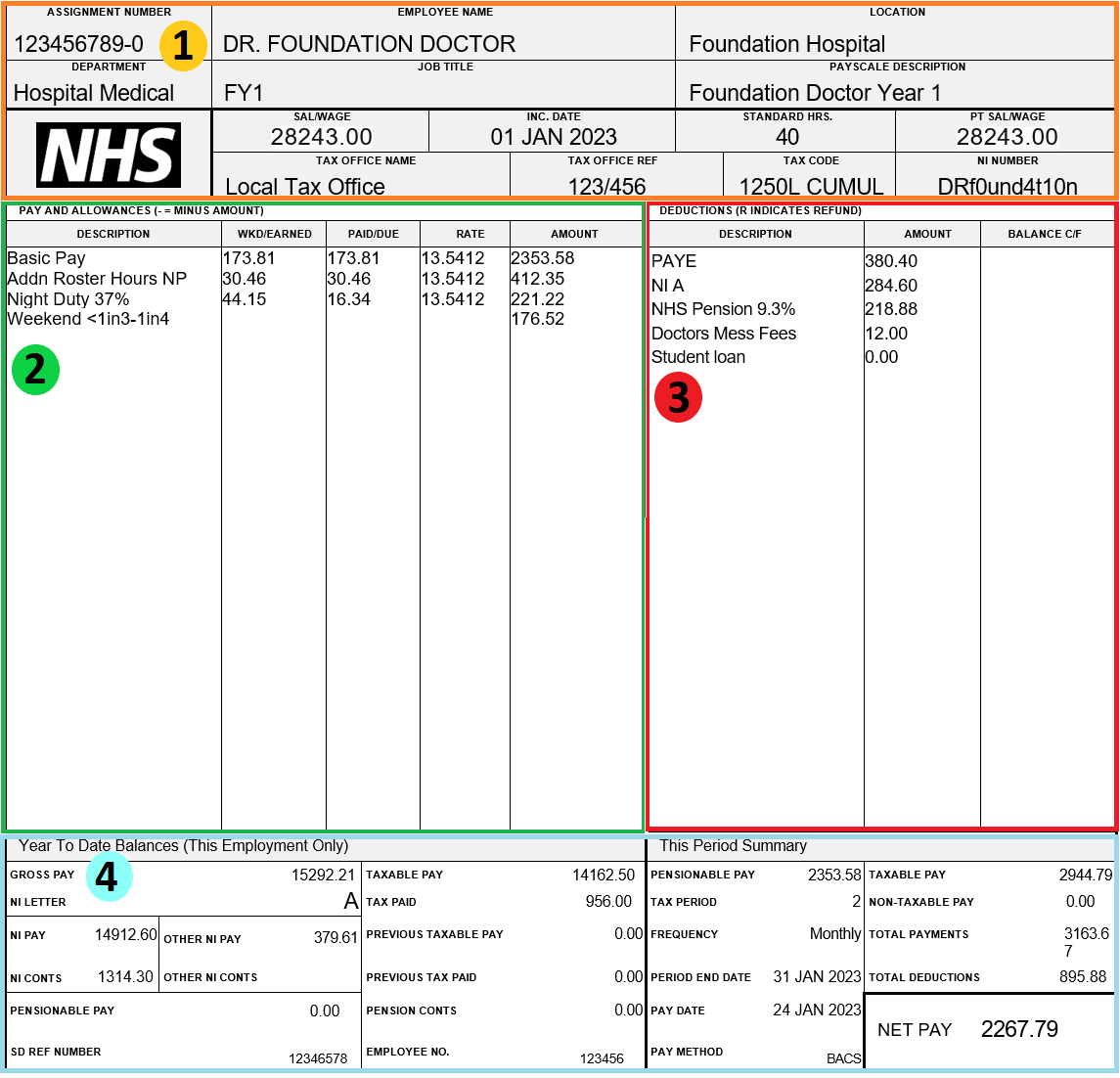

Picture this: It's payday and you log into your e-payslip to find this monstrosity of numbers and letters. It might seem overwhelming, but we'll break it down step by step. Take a look at the grids on the right, these are colour-coded for reference to the four different sections of your pay slip.

-

***Note: On Mobile - Tap on the picture to anchor it to the top of the page whilst you read each about each section***

-

1. Top section

- Employee Name

- Where you work

- What your role is

- Your annual (12-month total) Salary

- The average hours worked (Standard Hrs)

- Your Tax code --> Explained Here!

- Your local tax office code

- National Insurance Number

-

2. Payments

- Hours worked

- Hourly rate

- Additional hours (Addn) worked over 40 hours

- Night shift rate which is 37% of the standard rate

- Weekend rate. The example displays a rate for working less than 1 in 3 weekends.

-

3. Deductions

- PAYE - Pay-As-You-Earn income tax

- NIA - National Insurance Contributions

- NHS pension deduction (you can opt-out)

- Student loan repayments

- Other deductions e.g. Doctors Mess Fees

-

4. Balances and Summary

- On the left appear cumulative balances to date

- On the right you can see a monthly summary of gross (before deductions) and net pay (what is paid to your bank)

- Payment method - BACS is bank transfer

-

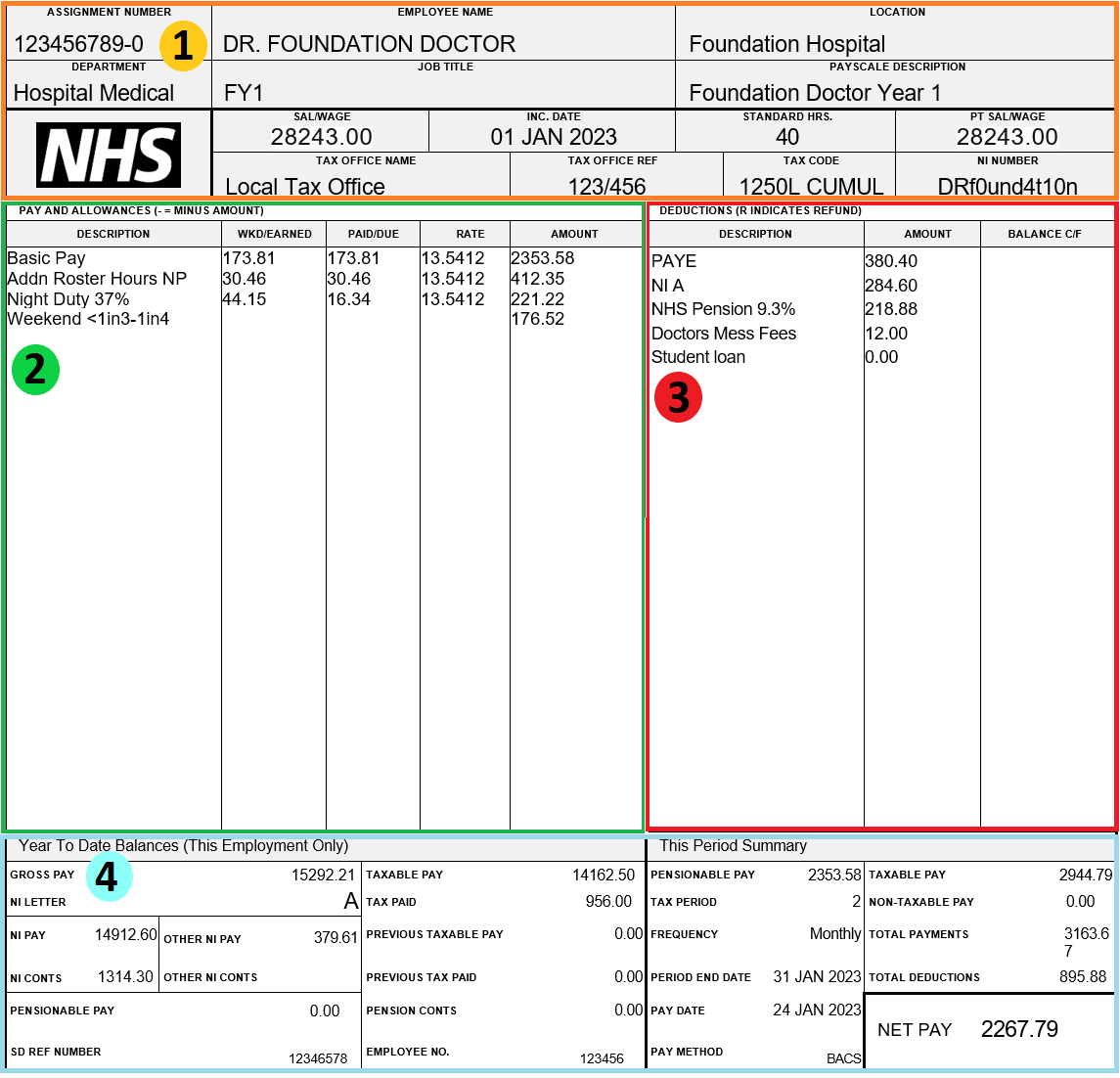

***Note: On Mobile - Tap on the picture to anchor it to the top of the page whilst you read each about each section***

-

1. Top section

- Employee Name

- Where you work

- What your job is

- Your annual (12-month total) salary

- The average hours worked (Standard Hrs)

- Your Tax code

- Your local tax office code

- National Insurance Number

-

2. Payments

- Hours worked

- Hourly rate

- Additional hours (Addn) worked over 40 hours

- Night shift rate which is 37% of standard rate

- Weekend rate. The example displays a rate for working less than 1 in 3 weekends.

-

3. Deductions

- PAYE - Pay-As-You-Earn income tax

- NIA - National Insurance Contributions

- NHS pension deduction (you can opt out)

- Student loan repayments

- Other deductions e.g. Doctors Mess Fees

-

4. Balances and Summary

- On the left appear cumulative balances to date

- On the right you can see a monthly summary of gross (before deductions) and net pay (whats paid to your bank)

- Payment method - BACS is basically bank transfer

Making the most of your money

Here is a list of some things that I have done to help make my money go further:

- 1. Open a Lifetime ISA: Save up to £4,000 per year and get a 25% bonus.

- 2. Budget: Identified areas where I could cut back (that subscription I thought I'd use but never really did).

- 3. Save Regularly: Set up automatic transfers to a savings account each month.

- 4. Make use of BlueLightCard: For around £5 you can get access to loads of discounts.

- 5. NHS Discount: Alongside the odd "bonus" of a mince pie at Christmas you can get access to the NHS discount. Just by asking I was kindly offered 20% off new tyres for my car despite no advert.

- 6. Claim for tax relief: You can reduce how much tax you pay by reporting your spending on necessary expenses such as:

- Memberships and Subscriptions e.g., BMA, BMJ, GMC, MDU, MPS, Royal Colleges

- Training Courses

- Medical Equipment and Clothing

For information check out the Tax Relief and Expenses page of the Gov.uk website.

FAQs

-

What happens if I am not paid on time?

This can happen when you start working, rotate jobs or if you have a deferred start date. If you have worked, you are owed the pay so you should contact the payroll team, escalate it to Human Resources (HR) and consider contacting the BMA for advice. In this scenario you may be asked to "wait" until next month to recieve the back-pay however you do not need to do this. You can always be paid through an emergency payment. Keep an eye on your tax codes and ensure you look through all owed payments, take a look at our Paycheck Explained article. It may be wise to consider any interest or overdraft fees accrued through this time as you may be able to make a claim to cover them.

-

How can I check my tax code?

Sign up and log in to Income Tax: HMRC Online Gov.uk. Here you will find a breakdown of your tax code including any changes. If you're not wanting to log-in you can take a look at this guide: HMRC: What Your Tax Code Means.

**Disclaimer**

Please note that neither we nor this website offer financial advice. The content provided here serves to introduce you to common topics you might not be familiar with. It is for educational purposes only. We recommend consulting with a qualified financial advisor for personalised advice tailored to your specific financial situation.